Isabel Stockton is a Senior Research Economist at the Institute for Fiscal Studies. Responding to today’s ONS figures on public finances, they said:

“Today’s report on government expenditure, debt, and income reveals pressure points for the Chancellor as we enter Spring Statement week. The forecast will include costings for announced cuts and reneged eligibility for health-related benefits. However, as we’ve seen with previous reform this will ultimately depend on how individuals respond and what we will witness. There are risks here. But, with the fiscal targets it has painted itself into the corner of, not raising taxes any further and not reverting to austerity for public services – the Chancellor has a limited supply of easy, cost-free, and risk-free choices.”

The Office for National Statistics published revised statistics relating to government revenues, spending, and borrowing today – meaning that we have now on a provisional basis, the first eleven months of data for the 2024-25 financial year. This would be the last time statistics are published ahead of next Wednesday’s Spring Statement.

- The Office for National Statistics has released updated statistics regarding government revenues, expenditures, and borrowing today – meaning we now on a provisional basis, have the first eleven months of information for the 2024-25 financial year. This will be the final statistic released before next week’s Spring Statement on Wednesday.

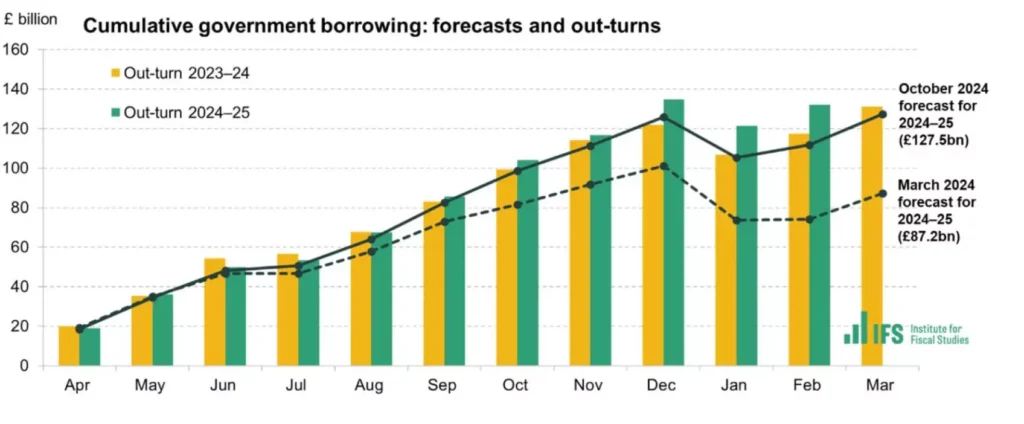

- Borrowing in 2023-24, the financial year nearly completed a year ago, stands at £131 billion, which is £9 billion up from the estimate made last October, and £17 billion higher than the forecast made in March 2024. The magnitude of the revision is yet another manifestation of the difficult and uncertain task of measuring the public finances, let alone forecasting 2029, the year covered by the Chancellor’s fiscal rules.

- Each year, a bulk of self-assessment income tax takings are made in January, but become more reliable when considering the February revenues for those payments that spill into that month. The release today confirmed the January data essentially: January (and February) revenues were still £4 billion, or 14%, below the October OBR forecast.

- In February, the government had to pay nearly £9 billion to service its debt, which is about £200 million higher than the forecast from October 2020. Recent developments in the markets have caused them to expect interest rates to be higher at least into the medium term than they did when the OBR prepared their forecast. Based on those expectations, the government may have to spend approximately £6 billion more on debt interest in 2029–30.

The OBR’s forecasts for next week have already been written, and in a broader sense, the monthly snapshots of data will matter less than the outlook going forward. The Chancellor’s fiscal rules, which were being met by a hair’s breadth in October, bind in 2029-30. Nonetheless, the data emphasizes the dangers of sluggish growth, weak tax receipts, and high, volatile debt servicing costs.

Figure 1 Borrowing forecasts, out-turn and extrapolation

Sources: Office for National Statistics, Public Sector Finances Time Series (series ID J5II) and Office for Budget Responsibility, Economic and Fiscal Outlook (October 2024): monthly profiles

Sources: Office for National Statistics, Public Sector Finances Time Series (series ID J5II) and Office for Budget Responsibility, Economic and Fiscal Outlook (October 2024): monthly profiles